A dividend paying stock produces a regular income stream for the investor, thereby reducing the impact of stock market fluctuations on a portfolio. Assume you have $200,000 to invest and must produce $10,000 from your stock investments every year to help cover your living expenses. If you can locate numerous stocks that pay an average of 5 percent dividend per year, your $200,000 investment will return $10,000 in dividend payments alone.

- For example, Walmart Inc. (WMT) and Unilever (UL) make regular quarterly dividend payments.

- This argument has not persuaded the many investors who consider dividends to be an attractive investment incentive.

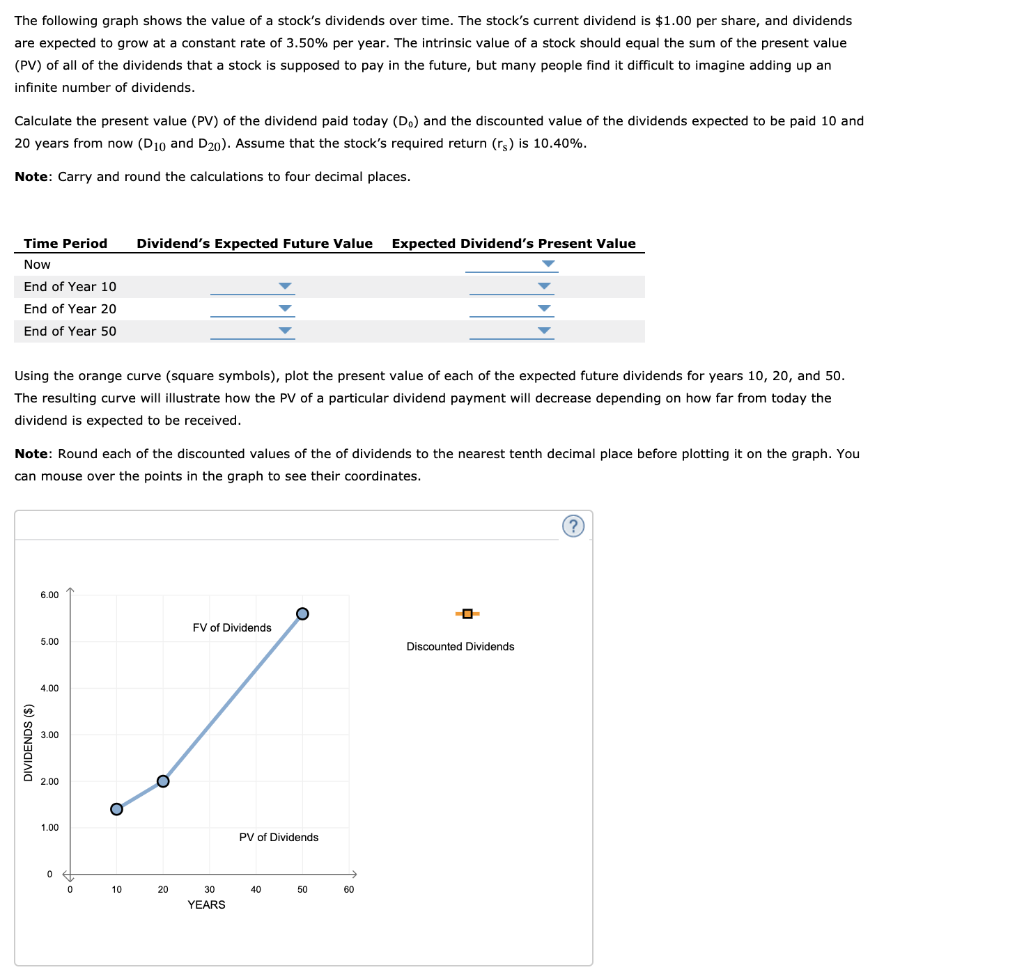

- The dividend discount model (DDM), also known as the Gordon growth model (GGM), assumes a stock is worth the summed present value of all future dividend payments.

- Because dividends are issued from a company's retained earnings, only companies that are substantially profitable issue dividends with any consistency.

- This increased interest in the company creates demand increasing the value of the stock.

How Dividends Affect Stock Prices With Examples

A stock dividend is considered small if the shares issued are less than 25% of the total value of shares outstanding before the dividend. A journal entry for a small stock dividend transfers the market value of the issued shares from retained earnings to paid-in capital. Dividend yield is a ratio that helps you understand the potential return for every dollar you invest in a stock.

Dividend Stocks vs Dividend Funds

Holding onto profits might lead to excessive executive compensation, sloppy management, and unproductive use of assets. Studies show that the more cash a company keeps, the more likely it is that it will overpay for acquisitions and, in turn, damage shareholder value. In fact, companies that new 2021 irs standard mileage rates pay dividends tend to be more efficient in their use of capital than similar companies that do not pay dividends. Furthermore, companies that pay dividends are less likely to be cooking the books. Let's face it, managers can be awfully creative when it comes to making earnings look good.

Reasons Why Dividends Matter to Investors

A dividend stream, especially when reinvested to take advantage of the power of compounding, can help build wealth over time. To compare multiple stocks based on their dividend payment performance, investors can use the dividend yield factor, which measures the dividend in terms of a percentage of the current market price of the company’s share. The increase in demand for dividend-paying stocks should not lead to the conclusion that receiving dividends is always better for the stockholder. Stockholders of companies with juicy growth prospects are sometimes better off not receiving dividends and have them instead reinvested into the business for maximum long-term growth. Shares of companies that pursue such a strategy are known as growth stocks.

You can also explore individual companies’ investor relations information and annual reports online. The ASX has a Dividend search tool you can use to explore past and current dividend announcements. It’s up to each company to decide whether it will pay dividends, how much profit to distribute, and how often.

To tarry over raising dividends, never mind suspending them, is seen as a confession of failure. The progression of Microsoft (MSFT) through its life cycle demonstrates the relationship between dividends and growth. When Bill Gates' brainchild was a high-flying growing concern, it paid no dividends but reinvested all earnings to fuel further growth. Eventually, this 800-pound software "gorilla" reached a point where it could no longer grow at the unprecedented rate it had maintained for so long. If Company X declares a 30% stock dividend instead of 10%, the value assigned to the dividend would be the par value of $1 per share, as it is considered a large stock dividend.

There have been three bear markets over the last 20 years, with dividend stocks outperforming during the first two, but during the most recent—amid the coronavirus pandemic—dividend-paying stocks underperformed. When the small stock dividend is declared, the market price of $5 per share is used to assign the value to the dividend as $250,000 — calculated by multiplying 500,000 x 10% x $5. For the company, a stock dividend is a pain-free way to issue dividends without depleting its cash reserves.

Conversely, a drop in share price shows a higher dividend yield but may indicate the company is experiencing problems and lead to a lower total investment return. Just as the impact of dividends on total return on investment, or ROI, is often overlooked by investors, so too is the fact that dividends provide a helpful point of analysis in equity evaluation and stock selection. Evaluation of stocks using dividends is often a more reliable equity evaluation measure than many other more commonly used metrics such as price-to-earnings, or P/E ratio. Dividend-paying stocks can also improve the overall stock price, once a company declares a dividend that stock becomes more attractive to investors.

The main risk is that there are no guaranteed dividends and they can be reduced or discontinued entirely as a company’s fortunes or priorities change. Companies can and do adjust their approach to dividends when it becomes strategically important for them to use profits in another way or when profits are waning. Many investors believe that if they buy on the record date, they are entitled to the dividend. A stock's capital-gains potential is influenced significantly by what the market does in a given year.